Growth Strategy 101: Volume, Value & Strategic Growth Levers

Jan 21, 2023

A little while back I was on a video conference with a team talking about one of the latest up-stream ideas they were preparing for development and commercialization. When asked about the concept they were able to summarize with great clarity and detail what they had developed. After that we asked about the target customer for the product. The seasoned R&D engineer chuckled and in partial jest proclaimed, "It is for everyone!" but then quickly followed up with a few specific consumers archetypes they had in mind. However, the jovial chuckles slowly transitioned to nervous laughter as we continued to ask how they expect consumers to react to the proposition and what value it will bring to the business. The subsequent answers of "buy it" and "make money" were far less jovial than the previous answer as the team realized they hadn't given this part of their concept nearly as much consideration.

These answers are not wrong. The goal was for consumers to buy it and for the company to make money– but they weren't helpful. They weren't specific enough to create a strategy about how the solution needed to be developed and delivered to customers.

We have all been there. This is a problem I have frequently seen (and been guilty of) over the years. The reality is, many innovators have a clear sense of what their concept is as a solution and how it will work, but have far less clarity on what it is as a business and how it will drive growth. I know, I know, we should be focused on solving the customer's problems, not the business'– after all, if we solve a valuable problem, value will certainly return, right?

I would like to think so, but I am not willing to stake my strategy on wishful thinking, and I assume the leadership funding the project wont either. Viability matters and so does the strategy to deliver it. If it isn't solving the needs of the customer AND the needs of the business it will likely never reach the customer you are so passionately trying to solve for and serve.

Viability Starts with How not How Much

I am a sucker for a good framework. So like many, I find myself regularly reaching for IDEO's now infamous desirability, viability, feasibility three circle venn diagram. However, simply saying something needs to be viable doesn't mean it magically will be. We need the right tools, terms and tactics to make it happen.

Talking about the economic side or financial implications is one of the fastest ways to stall a brainstorm. It can make people feel tense and uncertain. Numbers feel so absolute when–especially on the fuzzy front-end– nothing else feels certain. With so many question marks, economic models tend to feel like make believe and pixie dust. But that doesn't mean we discard viability, because viability isn't just about pointing at an opportunity and asking "how much?" but rather defining a clear strategy on how to deliver growth that provides the most value to the business and the people it serves. It isn't enough to point to a big TAM and bold claim you will take your slice of the pie. However, once you understand how you want to grow and what levers you can pull you can begin refining your models and sizing expectations in a meaningful manner.

How: Volume or Value

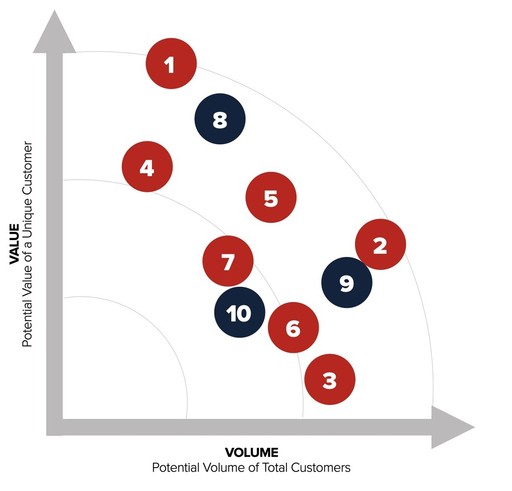

At the highest altitude, growth primarily comes from just two sources; volume or value. Understanding growth in its simplest terms like this help to not only make sense of the countless strategies and tactics necessary to achieve this growth but it also makes for useful inspiration and creative constraint on developing, refining, and testing ideas.

Volume: Increase the volume of customers your portfolio of products/services can reach and serve. There are a myriad of tactics to make this happen. New brands, new products, new categories, new partnerships and distribution channels, new geographical markets– even incremental improvements and marketing campaigns can all be means to reach new customers. But regardless of the tactic the goal is the same–grow the top line by growing the number customers your serve.

Value: Increase the value of customers you reach. Again, the countless methods could include premium offerings, subscription models, driving retention, increasing margin, new purchase occasions, reducing customer acquisition cost, or bundling products and service together to create more value. All of the methods for value return to the same end– grow the top line by growing the value of each customer you serve.

Armed with volume or value, viability becomes a much less daunting consideration in defining early stage opportunities. This decision isn't made in spreadsheets. It isn't about numbers and market share (yet). It is about direction, opportunity and clarifying objectives.

There are really only a few, finite levers to pull to realize this potential and often the needs of the business or the opportunity at hand make make it very clear what the growth goal should be. Are we leaving value on the table with customers we already serve? Or some combination of the two?

Creating More Clarity with Growth Levers

While this potentially overly simplistic view of growth is helpful in distilling down early decision making, it does lack for specificity and the delta between declaring, "Increase volume!" and developing a strategy and solution to get there is still very vast. To help drive to greater clarity, I have been turning time and time again to these four growth levers; increase market share, increase the addressable market, increase the average order value, and increase the lifetime value.

These simple strategies serves as levers you can pull to deliver on the volume or value ambition. The first two–volume levers–action the ambition of expanding customer reach, while the latter two–value levers–focus on how to increase per customer value.

1. Increase Market Share (Volume Growth Lever)

In mature and highly saturated categories, increasing market share is one of the most commonly reached for levers. Increasing market share assumes the market is stable and growth is best achieved by stealing share from competitors by meaningfully differentiating your offering through incremental improvement or experience optimization.

Using this Lever: If stealing market share is the primary strategy be clear to define the direction that volume will come from. Specifically if consumers are expected to trade up, over or down from a different competitor. This specificity determines if we are making improvements to reach underserved consumers or using low-end disruption to better meet consumer needs.

2. Increase Addressable Market (Volume Growth Lever)

In emerging categories it can be more common to focus on increasing the addressable market rather than competing for existing market share. However, increasing the addressable market is not reserved exclusively for new to world solutions and markets. Mature categories are just as at risk of overlooking consumers groups, especially as trends and consumer expectations change. Increasing the addressable market focuses on reaching previously unknown or unreached consumers and often require a change in business model or value chain to better serve a new customer.

Using this Lever: When increasing the addressable market defining the who is necessary for success. Clearly articulating who the overlook consumer is and why they are not reached by the category today is essential for determining the parameters for solutions and their success.

3. Increase Average Order Value (Value Growth Lever)

The direct-to-consumer model has provided greater insight and data into the cost to acquire a new customer and spoiler alert–acquiring new customers is expensive. That is why getting the most value out of each customer is smart business strategy. Writing off order value as the job of business ops, finance, or sales is a mistake. This lever is just as important to innovators as the other three. More than just increasing price, increasing average order value is a common lever behind developing adjacent products, top-tier experiences and premium product development.

Using this Lever: Maximizing the value of each transaction can be about incentivizing the number of products purchased, making recommendations or creating solutions and experiences that demand a price premium. As with the other levers, understanding consumer expectations and matching the solution to consumers who are under-served or over-served is critical for successfully activating the order value lever.

4. Increase Customer Lifetime Value (Value Growth Lever)

Rather than focusing on each transaction, the emphasis of this final lever is on the lifetime value of a customer. This is the driver behind the obsession with churn in industries with memberships or reoccurring payments, however, lifetime value is not reserved for Saas models and subscription services. Brand loyalty, entering in new occasions and building 1:1 relationships with customers to track and nurture the engagement overtime are key aspects of increasing a customers lifetime value.

Using this Lever: When addressing lifetime value, consider deeply the experience you offer. Either by developing literal experiences and services designed for repeat engagements and purchases or in the quality of the experience of a product. Wowing customers at every turn and promoting greater interaction increases customer loyalty and their subsequent lifetime value.

Turning Strategy into Action

Defining the how of a growth strategy provides five crucial benefits on turning an opportunity into action and in-market impact. When seen in this way growth isn't the job of a market analyst with a spreadsheet or a marketing manager with an ad budget. It is the shared responsibility of all parties, from start to end, to understanding why and how to drive growth that is meaningful and sustainable.

A Creative Sandbox- Clearly defining how growth is achieved provides the guardrails and expectations during brainstorms and concept development. Combining a consumer problem with a business ambition is a springboard for creative solutions. Business viability and growth mindsets shouldn't be a barrier to brainstorms they should be the catalyst.

Simplifying Sizing- Not all growth is created equal and market sizing can quickly turn into an exercise in wishful thinking and painting with broad brushes. Using growth levers focuses these efforts. Depending on the levers you need to pull will inform whether you are more focused on categories & CAGR or customers and LTV.

Forming a Testable Hypothesis- Selecting a growth lever is a form of a hypothesis. It is a way of saying, "we believe our solution will drive an X increase in Y lever (e.g. average order value)". With this hypothesis in place, quickly turn this strategy into an experiment to see if it is true is the best way to turn big ambitions into clear next steps.

Establishing OKR's- Objectives and Key Results are becoming an increasingly ubiquitous way to set goals and focus teams. A growth strategy is, as John Doerr defines objectives, "the stuff of inspiration and far horizons." The objectives and goals of a company should define the levers you pull– and vice versa. The tactics should inform the key results, knowing a tactics job is to move the needle, translating that to a key result is about defining which needle, in which direction and by how much.

Continuous Improvement with Pirate Metrics- There are many great frameworks for tracking and managing growth once you have a product in the market, but among my favorite is Dave McClure's Pirate Metrics (and not just because I love a good pun). Acquisition, Activation, Retention, Revenue and Referral (AARRR) provide a clear and flexible roadmap to inform where to focus and how to optimize growth. Having a clear read on how each of these items is performing creates you form game of growth, whack-a-mole (but hopefully less chaotic). Looking for opportunities to optimize and grow arise and set a plan in place to move the needle and strengthen the whole.